We have been advising a large number of institutional investors on development of a suitable rooftop solar PV model for roll out across commercial property portfolios. Across the market, a number of approaches have been taken towards structuring the underlying contractual arrangements – some of which appear unnecessarily complex. While certain bespoke circumstances or requirements will undoubtedly drive complexity, this briefing note provides a high level summary of a rooftop solar PV model that will be suitable as the basis for the majority of commercial property portfolios where the institutional investor wants to own the solar PV asset (whether directly or, more likely, via an SPV company).

Why consider rooftop solar?

There are a number of benefits of rooftop solar which an institutional investor can seek to exploit. These include:

- long term investment return – even without any renewable subsidy, the "pay-back" from solar can be sufficiently rewarding

- increasing the EPC rating of a commercial building

- diversification of energy supply which, in turn, contributes towards the sustainable procurement of green energy and a greater control of costs

- a positive contribution towards corporate social responsibility.

Structure

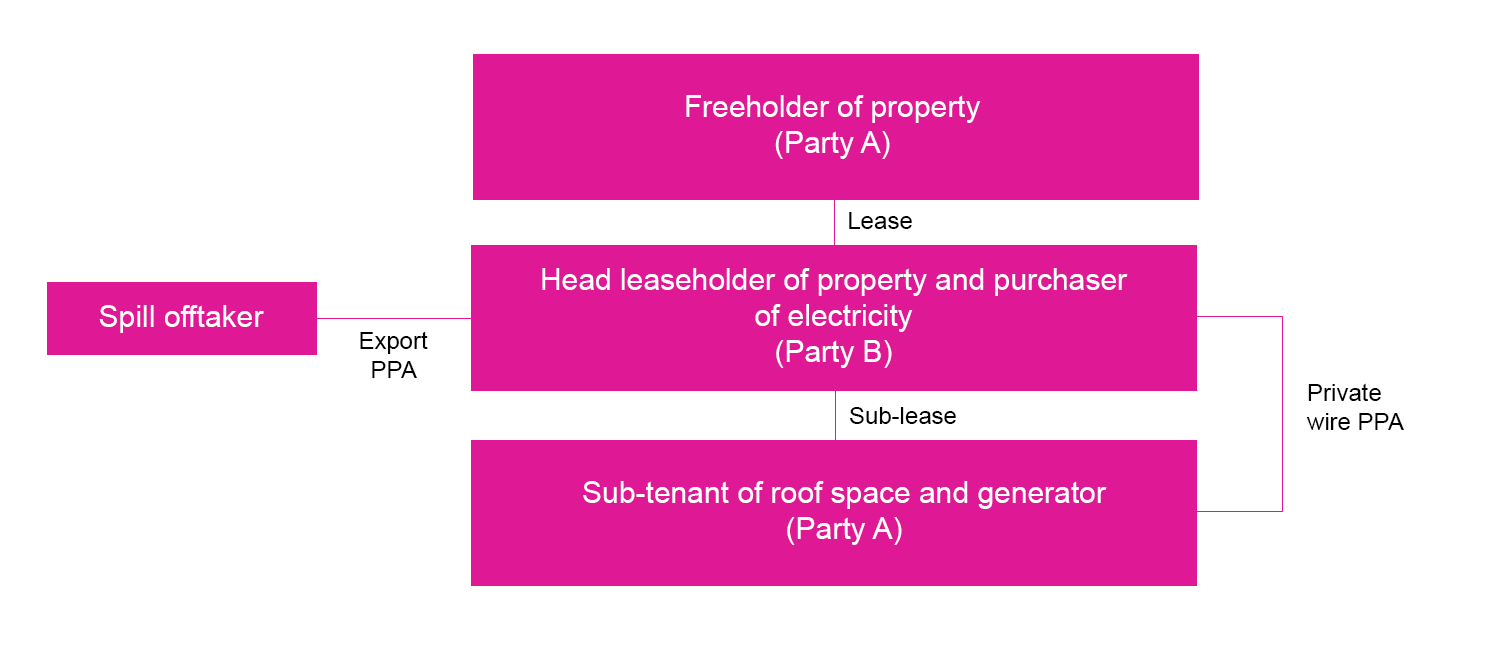

A structure that, in our experience, can simplify the contracts and enable a rooftop solar installation to proceed is based on the grant of a sub-lease of the roof space (a "sub-lease") by "Party B"(being the leasehold occupier of the property) to "Party A" (being the freehold owner of the property, and who will also take the role of sub-tenant with the benefit of the solar panels), as illustrated below.

A private wire power purchase agreement (PPA) will then be put in place for the sale by Party A (as generator) to Party B (as occupier) of electricity generated by the solar panels, which will be acquired by Party B in priority to any other electricity supply.

Any excess electricity that is not purchased by Party B will be "spilled" to the local distribution network for purchase by a third party under an export or "spill" PPA or, alternatively, Party A may elect to sell to its FIT Licensee and receive the FiT export tariff, if available.

To enable excess electricity to be "spilled" to the distribution network, the PV installation will need the benefit of an export connection. The form of this connection, the value of any connection costs and the necessary contractual documentation will differ depending on the size of the installation and its proximity to the grid.

In addition to the sub-lease and PPAs, Party A will need to enter into contracts with the solar contractor in respect of each rooftop solar PV installation. The first will be a contract for the design, construction, commissioning and testing of the PV panels (being the EPC Contract) and the second will be an ongoing operation and maintenance contract in respect of the PV panels (being the O&M Contract). Manufacturer warranties will also be issued in respect of key components. Arrangements can be drafted on a portfolio basis where there are multiple sites to be developed.

Key Issues To Think About

While not an exhaustive list, do consider whether the following need to be addressed in the project documents or as part of the wider arrangements. Experience in drafting and negotiating project documents for commercial rooftop solar installations is critical to ensure that all relevant key issues are identified and adequately addressed whilst ensuring that the document suite remains in line with market expectations and attractive to potential counterparties.

- Planning – will permitted development rights apply?

- Pricing of electricity under the private wire PPA – e.g. fixed price, discount against delivered retail etc.

- Change in law risk (and specifically who bears the risk of non-energy costs being levied on generators as license exempt supplier).

- Structuring of the energy supply arrangements to ensure they are within the available statutory exemptions for generation, supply and resale.

- Metering arrangements for generation, private wire supply and export volumes.

- Term of the sub-lease – typically, one day less than the head lease. Private wire PPA will automatically terminate/expire with sub-lease

- Sub-lease demise – typically the airspace of the whole or part of the roof excluding roof structures. Consider access rights for both parties.

- Availability of renewable subsidies and certification.

- Key EPC terms – e.g. delay LDs, guaranteed performance levels, liability caps, obligation to remedy defects post-handover.

- Key O&M terms – e.g. scope (scheduled and unscheduled maintenance), fees, performance standards.

For further information, contact Will Woodall or Nick Churchward, or visit our solar expertise page.