It is common for those not domiciled in the UK ("non-doms") – whether resident or non-resident – to own UK real-estate through an offshore structure. Typically this structure will consist of an offshore company; less commonly an offshore partnership. The company (or partnership) may well be owned by a trust.

The purpose of such structures has usually been to convert a UK asset (real-estate) into a non-UK asset (shares in an offshore company). This avoids UK inheritance tax (IHT).

Such structures – at least for residential property – have been under attack from tax changes since at least 2000, but particularly since the introduction of ATED in 2013, and CGT changes in 2013 and 2015. The final nail in the coffin was the announcement that, from April 2017, residential property in such structures would become subject to UK IHT. This removes the final tax-advantage of such structures.

In many if not most cases, residential-property structures will after 2017 be positively disadvantageous at least for tax purposes. However, non-tax advantages such as confidentiality are also rapidly diminishing.

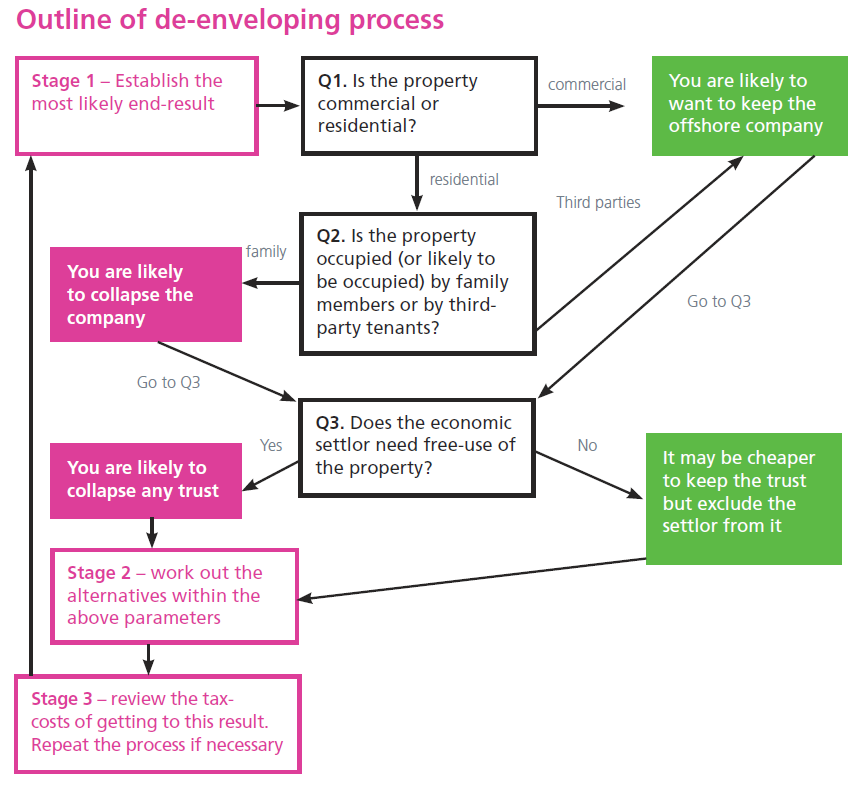

It has been clear since the announcement of the IHT changes that many structures will need to be dismantled. The question, until now, has been how and, in particular, whether the government would grant any reliefs ("de-enveloping relief") for any transactional taxes incurred during the dismantling.

This last question has now been answered: unfortunately with a clear "no". The government announced on 18 August that there would be no de-enveloping relief and that the proposals would go ahead from 6 April 2017.

How can we help?

Burges Salmon has one of the largest teams of lawyers dealing with non-dom clients anywhere in the UK.

We are pleased to offer a fixed-price review of a simple1 structure involving a questionnaire, a report tailored to that questionnaire and an optional one hour meeting with the client.

We can subsequently refine the recommendations in the report and assist with co-ordinating implementation. The price for either of these would be agreed separately.

For further information please contact John Barnett.

- Single property; single company; may or may not include a trust; may or may not include commercial borrowing.