The Non-Domestic Renewable Heat Incentive scheme is due to close at midnight on 31 March 2021. BEIS published its consultation in relation to this closure on 28 April 2020. This article explores some of the key consultation proposals.

The Non-Domestic Renewable Heat Incentive

In November 2011, the pioneering Non-Domestic Renewable Heat Incentive scheme ('the RHI Scheme') was launched in Great Britain to incentivise the generation of low carbon heat and injection of green gas (biomethane) into the gas grid.

The RHI Scheme is generally considered to have been a success. The core concepts - owners of accredited eligible installations receiving an index-linked, output-based support tariff (p/kWh) over a period of 20 years – have significantly accelerated the production of renewable heat and deployment of green gas to grid projects. Government figures for January 2020 indicate the RHI Scheme has helped to produce a total of 42,400 GWh of renewable heat and the injection of 10,017 GWh of biomethane into the gas grid.

As anticipated however, the Department for Business, Energy and Industrial Strategy ('BEIS') reconfirmed on 28 April 2020, through the publication of the consultation: 'The Non-Domestic Renewable Heat Incentive: Ensuring a sustainable scheme' ('the Consultation'), that the RHI Scheme will generally close to new applicants at midnight on 31 March 2021.

The Consultation acknowledges the need to future proof the RHI Scheme and the Renewable Heat Incentive Scheme Regulations 2018 ('RHI Regulations') and provide clarity to owners of accredited projects and those currently developing projects on issues relating to the closure. Stakeholders’ views are sought on a number of proposals.

We explore below some of these proposals, with a particular focus on the tariff guarantee regime and the treatment of biomethane and biogas installations.

Proposed Tariff Guarantee Changes

Background

Tariff guarantees, which were introduced in May 2018 for certain eligible installations, allow RHI Scheme applicants to secure a tariff rate[1] before their installation is commissioned and fully accredited by Ofgem or before biomethane for injection into the gas grid has occurred.

To secure a tariff guarantee, applicants currently have to go through a three stage application process:

- Stage 1 involves the submission of an initial application and certain evidence to Ofgem. An applicant only progresses to Stage 2 if there is available budget for a tariff guarantee for the relevant installation at Stage 1. An applicant’s Stage 1 application includes its expected commissioning date / date of injection of biomethane.

- Stage 2 involves the submission of financial close evidence (and currently network entry agreements for biomethane injection facilities) to Ofgem. The deadline for this is typically three weeks after Ofgem’s approval of an applicant’s Stage 1 application.

- Stage 3 involves the submission of commissioning evidence to Ofgem and the completion of application forms. The deadline for this is currently the earlier of 31 January 2021 and six months after the commissioning date specified by an applicant at Stage 1.

An installation’s tariff guarantee expires if the relevant applicant fails to submit the required information, evidence and applications by the applicable deadlines.

Proposed Changes

In line with the announcement in the March 2020 Budget, the government is proposing to introduce a third new allocation of tariff guarantees to the RHI Scheme. This new allocation may allow certain applicants to submit reduced Stage 2 information[2] prior to the closure of the RHI Scheme on 31 March 2021, with the deadline for satisfaction of the Stage 3 requirements being as late as 31 March 2022. Developers would therefore potentially have up to another year to build out and commission their projects whilst still preserving the guaranteed tariff level for their installation.

The accompanying Impact Assessment also suggests that the government may, as a response to potential COVID-19 delays, change the final commissioning deadline for the current cohort of developers holding tariff guarantees. The deadline will move from 31 January 2021 to at least mid-March 2021, with the requirement to commission no later than six months after the commissioning date given at Stage 1 being removed entirely.

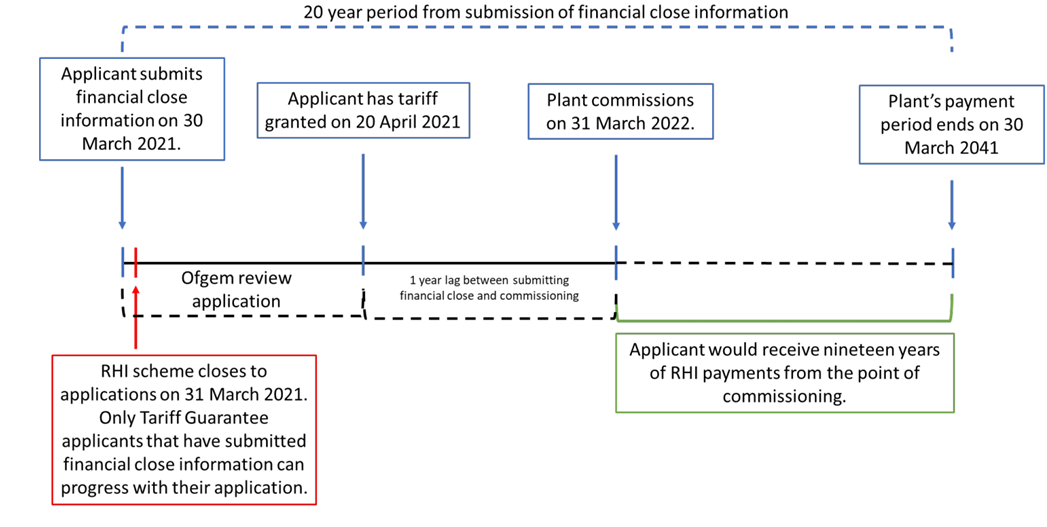

Importantly though, the government is proposing that RHI Scheme payments for eligible installations that secure a tariff guarantee in the third allocation round will commence from the point the applicable installation is commissioned (and evidence submitted), but with the installation’s 20 year tariff period commencing on the day the applicant submitted the financial close evidence. The Consultation also expressly states that no RHI Scheme payments will be made after 31 March 2041. The diagram[3] below provides an example of how this would work.

The Consultation also indicates that new tariff guarantee headrooms will be set for the period 2021/22 and 2022/23 financial years, with new technology specific headrooms. These are expected to be published at the same time as the government publishes its Consultation decisions.

Proposed Biomethane and Biogas Project Changes

Background

Increased deployment of gas to grid and biogas combustion projects has been one of the big success stories of the RHI Scheme, kick-starting the biomethane/biogas industry and promoting energy from waste.

As the RHI Scheme has evolved though, with the government focussing on value for tax payers, the rate of deployment of biomethane/biogas projects has tailed off. Accredited installations have also been subject to ever stricter requirements in areas including feedstock sustainability and the interaction between the RHI Scheme and other environmental schemes such as the Renewable Transport Fuel Obligation (RTFO) which enables certain developers to accrue Renewable Transport Fuel Certificates (RTFCs).

A good example is that due to the definitions and calculations within the RHI Regulations, specifically around ‘eligible biomethane’, biomethane producers are currently unable to submit a partial claim for RHI Scheme payments within a given quarter. Biomethane producers must instead either claim entirely for RHI Scheme payments or RTFCs in a given quarter. This has restricted the potential for producers to benefit from diversified revenue streams and in some instances has probably disincentivised production beyond an installation’s limit for tier 1 payments (i.e. the highest tariff rate payable up to a certain volume of biomethane injected in a 12 month period).

Certain anomalies in the RHI Scheme Regulations have also caused problems with the sale of gas to grid installations and the debt financing of such installations. The Consultation acknowledges this and confirms the Government’s intention to make certain amendments to the RHI Scheme to provide greater flexibility to the industry whilst also ensuring the appropriate sustainability criteria are met.

Proposed Changes

Reflecting the above, the Consultation proposes:

- that a new mechanism be inserted into the RHI Regulations to enable the transfer of ownership (e.g. asset sale) of accredited biomethane facilities and their associated payments. This will bring the transfer treatment of such installations into line with other RHI Scheme accredited installations[4];

- to amend the RHI Regulations in order to clarify that the same rules apply for anaerobic digestion feedstocks as they do for pyrolysis and gasification installations. This is to ensure that the sustainability criteria for the RHI Scheme is being met by anaerobic digestion plants, there is parity between technologies and accurate carbon savings are being attributed to the RHI Scheme; and

- to amend the RHI Regulations to enable biomethane producers to claim support across multiple schemes within a quarter in relation to different consignments of biomethane. To avoid over compensation for producers however, the Consultation makes clear that the government proposes to:

- make it a formal requirement that support cannot be received for a consignment of biomethane under the RHI Scheme where such consignment has also received support under another scheme such as the RTFO;

- give the scheme administrator additional powers to take enforcement action in instances where this is suspected to be the case; and

- require producers to report total biomethane injection volumes to the scheme administrator before declaring the portion of gas on which RHI Scheme payments will be claimed.

Other Notable Proposed Changes

Additional Capacity/Biomethane – reflecting the general closure of the RHI Scheme to new applicants, the RHI Consultation indicates the government’s intention to end the option to add capacity to existing plant following the closure of the RHI Scheme at midnight on 31 March 2021. Owners of accredited installations will however still need to notify Ofgem if any additional capacity / biomethane capacity is added to their plants / injection points to ensure that such capacity does not receive RHI Scheme payments.

Waste Wood – the RHI Scheme allows for the burning of some types of waste wood in biomass boilers. To qualify for payment, any relevant environmental permit must be in place. In line with the government’s response to its consultation on biomass in urban areas however, the government intends to restrict RHI Scheme payments to participants who use waste wood in their biomass installations, to only those participants that burn pre-consumer waste wood and have the relevant permit or waste exemption to do so.

Comment

Whilst there will be disappointment that the government has decided not to extend the life of the RHI Scheme by a year, as it has with the domestic renewable heat incentive scheme, there are some positive proposals within the consultation. If implemented, the proposals will provide very helpful clarity to those developers who are currently constructing installations and are potentially affected by COVID-19. The proposals should also provide comfort to those sponsors and lenders looking to reach financial close in relation to new installations ahead of the 31 March 2021 deadline.

The refinement of the RHI Scheme Regulations in relation to the transfer of ownership of biomethane injection installations will also be appreciated by the finance community and potential sponsors, as will the enabling of biomethane producers to diversify their income streams within a quarter. This is something which has been on the wish list of many operators for a while.

Certain elements of the Consultation proposals may benefit from further scrutiny and refinement. This includes the proposed revised tariff guarantee regime, which would require developers to walk a very fine line between ensuring they secure a tariff guarantee prior to the 31 March 2021 deadline (given the limited budgets available) and trying to minimise the risk of their installation’s tariff period being eaten into. Further clarity on the interaction between the RHI Scheme and the RTFO would also be welcome, as this is a notoriously tricky and complex area.

What happens next

Interested parties will want to consider the impact of the Consultation proposals and if they believe it would be helpful, may want to respond to BEIS via the requested channels.

The consultation is due to close on 07 July 2020 and a link to the consultation documents can be found here.

How can Burges Salmon help?

For many years Burges Salmon has been at the forefront of the low carbon heat and green gas sector and the low carbon transport sector, having advised on many of the market leading development projects and financing transactions. This article was written by Alec Whiter. If you have any questions on the Consultation, or the sector generally please contact James Phillips or Alec Whiter.

[1] for up to 250GWh of heat or biomethane produced in each 12 month period by that installation

[2] There is an indication that there may not be a need for network entry agreements to be provided in respect of biomethane injection facilities

[3] Diagram taken from Annex A of the BEIS Impact Assessment

[4] The difference in treatment arose due to a biomethane injection installation not being an 'eligible installation' (and thus 'accredited RHI installation') for the purpose of the Scheme Regulations and thus not covered by regulation 54 (change in ownership).