Agriculture and estates

Expert legal advice across the agriculture sector, tailored to meet the evolving challenges of rural land and estates.

Agriculture and estatesThis website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

Expert legal advice across the agriculture sector, tailored to meet the evolving challenges of rural land and estates.

Agriculture and estates

Combining in-depth sector knowledge with technical legal excellence, our built environment lawyers provide exceptional advice to support at each stage of a building’s lifecycle.

Built environment

We have the most experienced defence practice in the UK, working across maritime, air, land and communications & cyber.

Defence

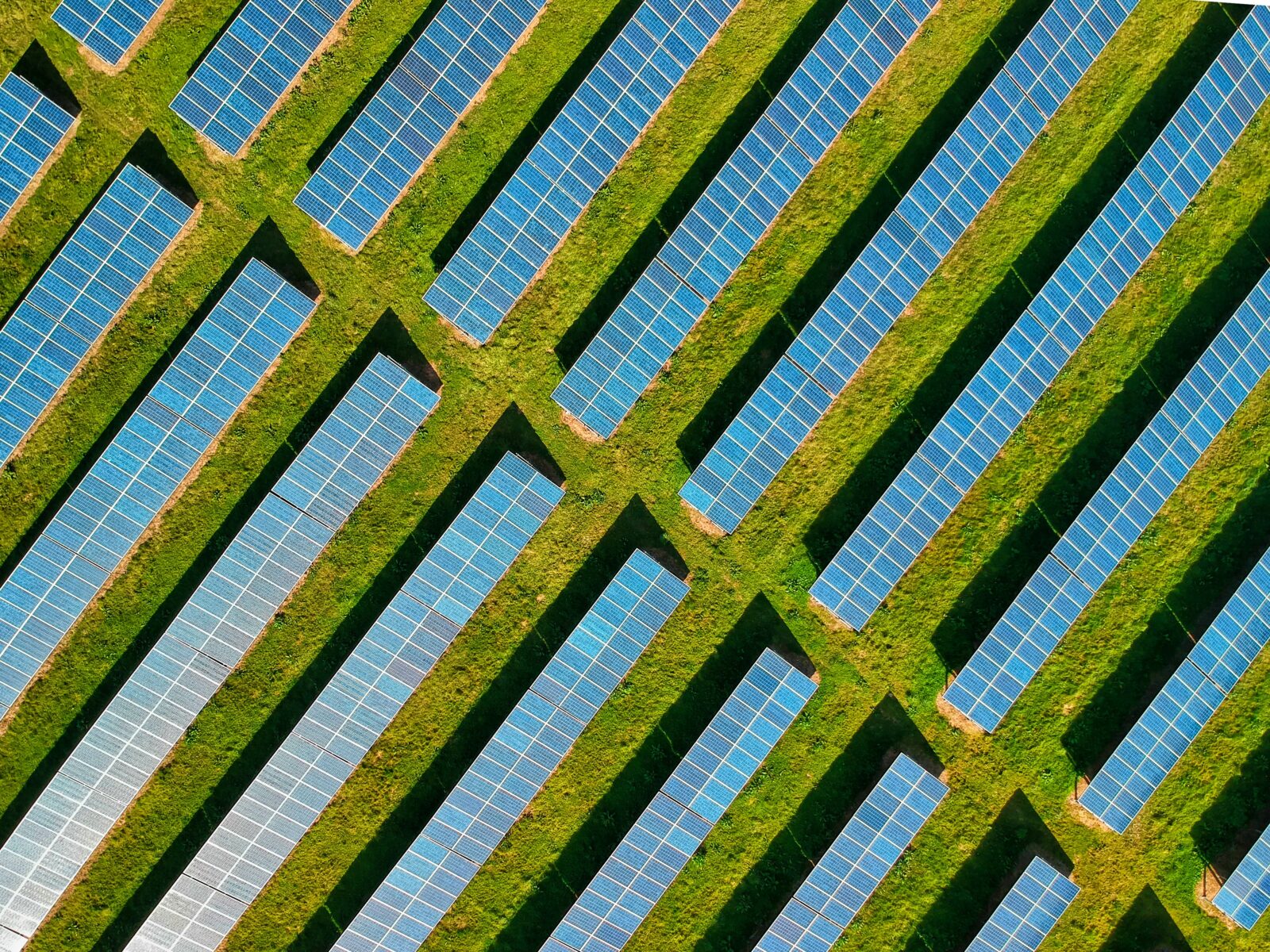

Legal support across the energy and utilities sector, delivering tailored solutions to navigate regulatory, environmental and operational challenges.

Energy and utilities

A highly experienced team of genuine financial services specialists supporting a wide range of clients, from to start-ups to industry leaders.

Financial services

Our leading health, care and life sciences lawyers provide tailored legal solutions for UK and international clients, from the most complex projects to the day-to-day matters and everything in between.

Health, care and life sciences

Market-leading expertise in the hotels and leisure sector, combining industry insights with outstanding legal experience to provide tailored solutions and best outcomes for clients.

Hotels and leisure

Advice on large scale infrastructure projects across all sub-sectors including transport, energy, defence and social infrastructure, offering expert legal support at every stage.

Infrastructure

One of the largest dedicated private wealth teams in the UK, recognised nationally and internationally for providing exceptional advice to individuals and families across all aspects of your global wealth.

Private wealth

Public sector lawyers trusted by public bodies and their private sector partners to help you rise to the unique challenges of government, from the most complex programmes to day-to-day policy delivery.

Public sector

Pragmatic advice to help you succeed in a fast-evolving industry, whether your business is at the forefront of technological innovation or seeking to adopt new technologies.

Technology

Navigate the challenges of the transport sector with our expert legal support across rail, road, aviation, marine and ports.

Transport