FCA launches consultation on new sustainability disclosures for listed companies

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

/Passle/5d9604688cb6230bac62c2d0/SearchServiceImages/2026-02-13-08-46-16-744-698ee4d85f26130ee7f11671.jpg)

The FCA has launched its long awaited consultation on introducing requirements for UK listed companies to report against the UK Sustainability Reporting Standards (“UK SRS”).

UK listed companies currently report against the Task Force on Climate-related Financial Disclosures (“TCFD”) framework. This framework was disbanded in 2023, and the International Sustainability Standards Board (“ISSB”) has now taken up the mantle of guiding global sustainability disclosures. The sustainability reporting standards prepared by ISSB are aiming to unify fragmented climate and sustainability reporting frameworks. Around 40 jurisdictions are planning to adopt, or already use, the ISSB standards. It is in this context that the UK is developing its own ISSB-aligned standards, the UK SRS, to replace and expand on the existing TCFD framework. The UK Government continues to develop the UK SRS, and these were subject to a separate consultation in June 2025.

Applicability

The FCA consultation proposes that companies in the main commercial, transition, non-equity shares, and non-voting equity shares listing categories would be required to comply in full with the UK SRS. This blog explains the proposals for these companies.

Companies with a UK secondary listing or depository receipts will be subject to lighter-touch rules, which are not discussed further here.

What is ISSB 1 and 2

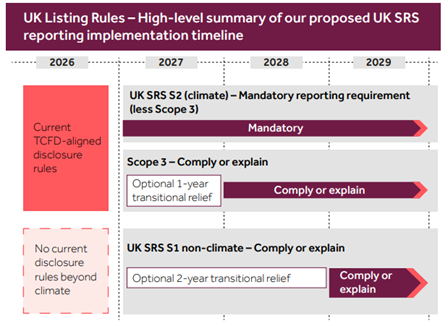

The UK Sustainability Reporting Standards consist of SRS S1 and SRS S2, which will be introduced in a phased way.

UK SRS S2 broadly corresponds with the existing TCFD recommendations. SRS S2 requires additional detail to the TCFD requirements, including disclosure in relation to greenhouse gas emissions, transition plans and industry-based metrics. SRS 2 requires disclosure of scope 3 emissions. Given the challenges that businesses face in reporting scope 3 emissions, the draft standard includes a one-year transitional relief for reporting on scope 3 emissions. In addition, the FCA is proposing that scope 3 emissions reporting may be done on a “comply or explain” basis, once the one year transitional relief has elapsed.

UK SRS 1 requires disclosure of broader sustainability-related risks and opportunities and so represents an expansion of the UK’s ESG disclosure requirements, which previously has only required mandatory climate disclosures. To support companies in preparing these disclosures, the FCA is proposing that non-climate related sustainability matters may be reported on a “comply or explain” basis. In practice, this would mean in scope companies either report against UK SRS 1 or they could explain their approach to reporting any identified sustainability-related risks or opportunities. The current draft of UK SRS 1 includes a 2-year transitional relief period for disclosure under SRS 1.

The FCA has prepared a helpful diagram setting out the timeline for the introduction of these requirements:

(Source: FCA consultation).

Transition planning

Companies are not currently required to prepare a climate-related transition plan, nor are they required to do so under the UK SRS. As part of these changes to sustainability reporting, the FCA is proposing to require companies to state in their annual report whether they have disclosed a climate-related transition plan, and if not, why that company does not have a transition plan. The Government separately consulted in 2025 on transition plans and so we may see further developments relating to transition plans as part of separate proposals.

Timing

The FCA is proposing that the new disclosure rules come into force from 1 January 2027 and would apply to accounting periods beginning on or after 1 January 2007, subject to the transitional reliefs discussed above.

What next?

The consultation is open until 20 March 2026. We expect that the FCA will finalise their rules and publish their policy statement in autumn 2026, subject to UK SRS being finalised.

Companies that are expecting to be in scope of the new sustainability reporting requirements should start to assess their preparedness for disclosure against the new requirements, particularly in relation to UK SRS S2 which will be the first new mandatory disclosure standard to apply.

We advise numerous clients on their reporting obligations under various environmental and ESG regimes. Please contact Michael Barlow ([email protected]) or speak to your usual Burges Salmon contact if you would like to discuss these proposals further.

Written By Lucinda Huntsman

The government has set out its ambition to be a world leader in sustainable finance. This includes strengthening the UK’s attractiveness as a destination for inward investment, by ensuring that corporate sustainability-related reporting is credible and useful for decision-making, thereby supporting investor confidence and trust.

Want more Burges Salmon content? Add us as a preferred source on Google to your favourites list for content and news you can trust.

Update your preferred sourcesBe sure to follow us on LinkedIn and stay up to date with all the latest from Burges Salmon.

Follow us