Sustainable Aviation Fuel: On the Flight Path to Revenue Certainty – Part 1

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

/Passle/5d9604688cb6230bac62c2d0/SearchServiceImages/2026-01-28-11-00-24-497-6979ec483a3778c07489d10d.jpg)

Back in October 2025, the UK Government consulted on how to fund its proposed revenue certainty mechanism (RCM) supporting production in the UK of sustainable aviation fuel (SAF) (see our previous article). The government has now taken the next step in readying the RCM for take-off by launching a new consultation on its “minded to” positions on the proposed terms of the contracts for difference (which can be found here) which will deliver the RCM support to SAF producers and the rules that will apply for the first allocation round of the RCM contracts (known as SAF AR1).

This article focuses on the indicative Heads of Terms (HoTs) provided with the consultation. We will shortly be publishing Part 2, looking at the proposed approach for SAF AR1.

Proposed Contract Terms

As confirmed in January 2025, the government has elected to deliver the RCM using a Guaranteed Strike Price mechanism and a contract for difference. This approach (and many of the proposed contract terms) will be familiar to those with knowledge of the low carbon electricity contracts for difference (CfDs), the low carbon hydrogen agreement and the industrial carbon capture revenue support scheme.

Under this approach, the SAF producer and a government-backed counterparty will enter into a private law contract which sets a price (Strike Price) that the SAF producer is guaranteed to receive for its qualifying volumes of SAF. A reference price (typically representing the market price of the SAF) will determine whether a payment is due from, or to, the relevant SAF producer. Where the reference price exceeds the Strike Price, the producer pays the difference to the counterparty but, where it is below the Strike Price, the producer is paid the difference by the counterparty.

The HoTs provided as part of the consultation detail some of the proposed terms for the RCM contracts to be included as part of (at least) SAF AR1. Below, we have set 5 of the key areas to be aware of:

It is proposed that the RCM support is provided for a maximum of 15 years, in line with other UK low carbon business models that also use a CfD approach to provide revenue certainty.

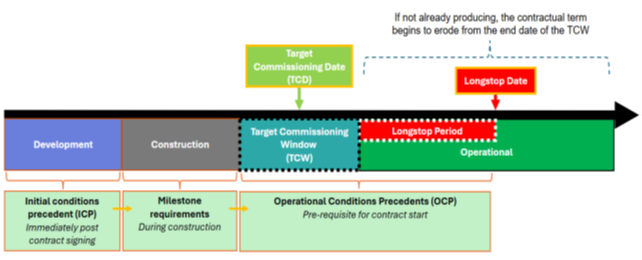

The SAF producer will be required to satisfy certain conditions precedent (including achieving project milestones) before the commencement of the RCM support period and within a “Target Commissioning Window” (TCW) . If the producer is late in delivering the project, the period of revenue support will start to erode.

The HoTs include a Longstop Date (following the end of the TCW) for satisfying the operational conditions precedent which, if not achieved, may result in termination of RCM contract. This device is intended to allow (government's) committed funding to be redeployed rather than being tied up in projects with no realistic prospect of being commissioned. Extensions of time to the TCW and the Longstop Date are permitted for events of force majeure and certain delays to utilities and CO2 network connections.

The below figure (taken from the consultation) is helpful is illustrating the various periods and deadlines:

2. Calculating the reference price

The reference price is the benchmark against which the strike price is compared. This would usually represent the market price for the relevant product but as there is not currently a market price for non-HEFA SAF (i.e. SAF made from sources other than animal fats and cooking oils) there is currently no established market price. So, the government has proposed use of an alternative proxy for the RCM while the market matures.

The consultation document sets out three alternative potential options for this proxy reference price:

The government has not provided a “minded to” position on which of these options to adopt and is seeking stakeholder views. It is worth noting that:

views are being sought on whether it is possible for the reference price to transition from the proxy to a reliable market price (once this is determined for the SAF market) during the term of the RCM contracts.

3. Price Adjustments

The consultation also sets out several proposed incentives and price adjustments for the Strike Price. It states that:

The HoTs propose a number of caps, floors and restrictions on SAF volumes sold:

”Qualifying Offtakers” and “Non-Qualifying Volumes (NQVs)” – the difference payment will only be payable to the SAF producer on volumes of SAF produced by the SAF facility, which meet the sustainability criteria and are sold to a “Qualifying Offtaker”. The HoTs envisage several classes of non-qualifying offtakers including a class aimed at preventing SAF producers receiving difference payments in respect of SAF which is exported outside of the UK. However, where NQVs are sold in excess of the Strike Price, the producer must still pay any Strike Price excess to the counterparty.

The HoTs propose that RCM contracts will be underpinned by the same sustainability criteria as the UK SAF Mandate. However, as the SAF Mandate is a regulatory instrument that could be subject to amendment over time there is a need to consider how to manage any misalignment which appears in the event that the sustainability criteria in the mandate are updated.

The consultation is therefore seeking views on whether the sustainability criteria in the RCM contract should remain the same throughout the term of the RCM contract (i.e. the SAF mandate criteria would “grandfathered”), be updated in line with the SAF mandate or, even, whether there should be any criteria at all.

Next steps

At this stage, the HoTs remain indicative and, whilst it sets out a number of “minded to” positions, the consultation seeks responses from stakeholders to inform the final decisions. The consultation closes on 3 April 2026 and the government anticipates that the required legislation to implement the RCM will be laid by the end of 2026, including any associated regulations.

If you would like support from us in reviewing the HoTs and providing a response to the consultation or any further information, or advice related to any of the information in this article, then please contact Nick Churchward, Greg Fearn or your usual Burges Salmon contact.

This article was written by Nick Churchward, Greg Fearn and Sasha Anisman.

The government is committed to decarbonising aviation in support of our missions to kickstart economic growth and make Britain a clean energy superpower, and to achieve our legislated climate targets.

Want more Burges Salmon content? Add us as a preferred source on Google to your favourites list for content and news you can trust.

Update your preferred sourcesBe sure to follow us on LinkedIn and stay up to date with all the latest from Burges Salmon.

Follow us