The UK’s Temporary Non-Residence Rules

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

This article is part of our series covering a number of core concepts relevant to the application of UK tax to individuals and wealth owning structures which have an international connection.

Whether an individual is tax resident in the UK in a particular tax year (which runs from 6 April one year to 5 April the next) is governed by the “Statutory Residence Test” (the “SRT”). See our article entitled “Residence, Long-Term Residence and Domicile: what do they mean?” for more on this. All references to “residence” in this article are to tax residence as determined by the SRT.

Ceasing to be tax resident can significantly reduce exposure to UK taxation. This is particularly relevant for income tax and capital gains tax, which non-residents only pay in limited circumstances, such as if they work in the UK and/or have interests in real estate here.

The temporary non-residence rules (the “Rules”) were introduced to stop people becoming non-UK resident for just a short period to take advantage of this reduced tax exposure (e.g. to dispose of an asset, or receive a dividend).

Where the Rules apply, certain types of gains realised and/or income received whilst non-UK tax resident can be subjected to UK tax when the individual becomes UK tax resident again. Because of this, it is often sensible to plan periods of non-residence to ensure that the Rules cannot be triggered.

The Rules should generally be considered whenever the following fact pattern is present:

An individual can be caught by the Rules (and be considered “temporarily non-resident”) if:

1. They were UK tax resident for at least 4 of the 7 tax years prior to the period of non-residence; and

2. The period of non-residence is 5 years or less.

The second of these is something of a trap for the unwary because in practice being non-UK tax resident for more than 5 years often requires a person to live outside of the UK for well over 5 years.

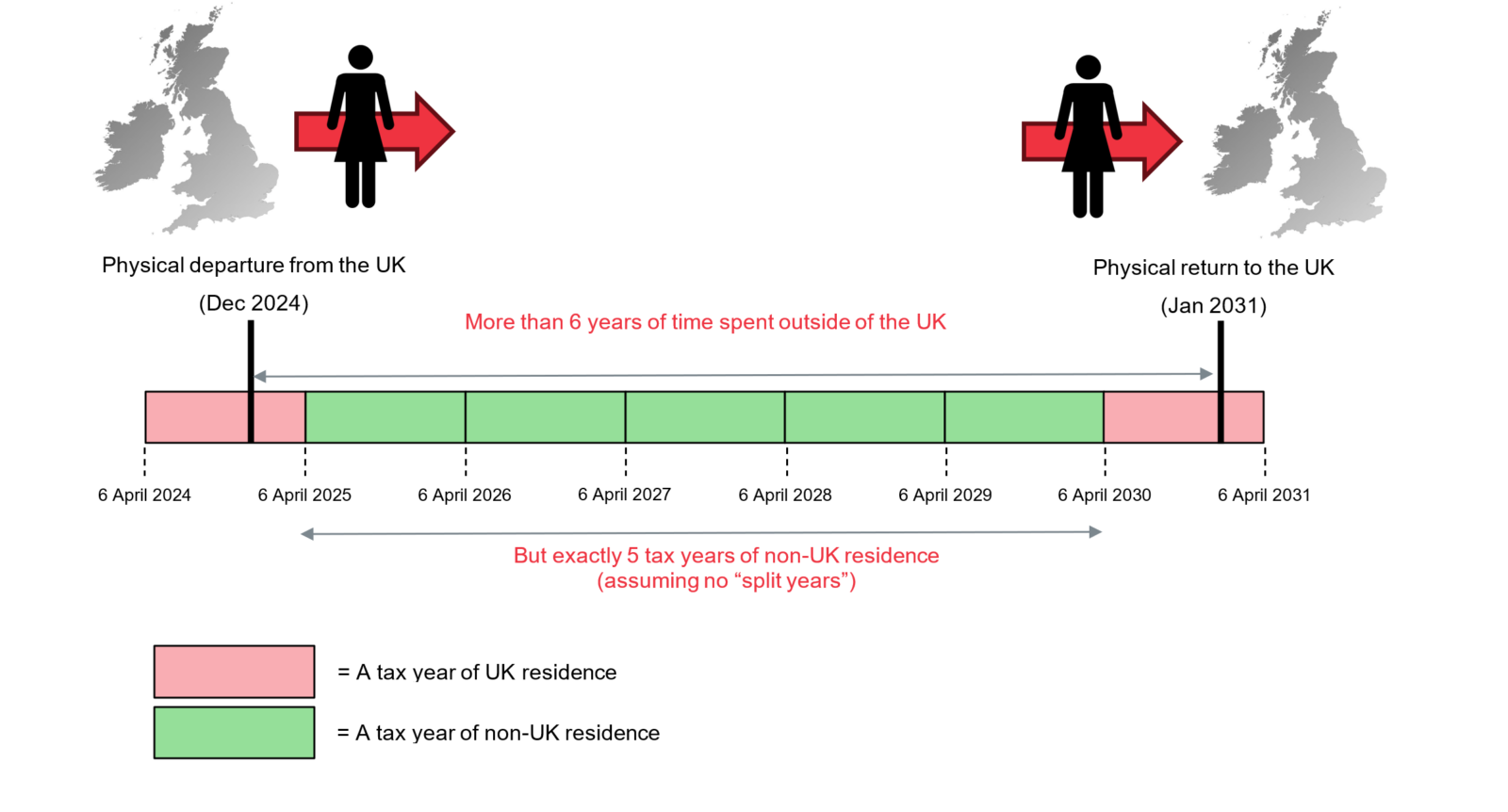

By way of example, if someone were to leave the UK in December 2024 and then return in January 2031 they might quite reasonably think that they had been living elsewhere for over 6 years and couldn’t possibly fall foul of the temporary non-residence rules. However, depending on their circumstances, it is feasible that they could be UK tax resident in both the tax year of departure (2024/25) and the tax year of return (2030/31). This would mean that they were only non-UK resident for 5 tax years exactly, rather than more than 5 as is required (unless they could “split” one or both of the year of departure or return).

To show this visually:

If someone does not want to be within the scope of the Rules they must therefore plan their departure and return carefully so as to ensure that they are non-UK resident for more than 5 years. In practice this generally means either:

As alluded to above, double tax treaties can have a significant impact on the application of the Rules and particular care must be taken to factor in any periods of Treaty residence in another jurisdiction. This can lead to surprising results.

Whilst this article does not set out a comprehensive list of the types of gains and income which can be caught, it is important to be aware of the following:

Most gains realised during the period of non-residence will be subject to UK capital gains tax when the person becomes UK tax resident again.

Conversely, most forms of income received in the period of non-residence are not within the scope of the Rules and so will not be subject to UK tax on the individual’s return.

However the Rules can apply to:

For these purposes a “close company” is generally a company which:

If an individual is a remittance basis user (either before they leave the UK or when they return) this must also be factored into the analysis as it can impact the Rules in a number of ways. For example:

The tax rates applicable in each case are the tax rates in force when the person becomes UK tax resident again, not those which applied at the time the relevant gains were realised or the relevant income arose.

A potential issue for anyone caught by the Rules is that they can effectively take tax liabilities which would otherwise have arisen across several years and condense them into a single tax year, pushing the taxpayer into higher marginal tax rates and/or reducing available allowances.

One possible benefit associated with being temporarily non-resident is that it can allow losses realised during the period of non-residence to be offset against gains when the person returns to the UK. However, the situations in which this is a net positive for the taxpayer will be relatively niche.

As stated above, if an individual is within the scope of the Rules then most types of gain they realise whilst non-UK resident will be subject to UK capital gains tax upon their return.

One important exception is for gains realised on assets which are acquired by the individual during the period of non-residence. However, this is subject to its own caveats, particularly in relation to assets acquired as a result of a no gain/no loss disposal (such as those between spouses) or which benefited from capital gains tax roll-over relief.

The temporary non-residence rules can be a nasty trap for anyone who leaves the UK for a short period and has not given them thought. Careful planning is essential, particularly if significant income or gains might arise whilst non-resident or if the individual is a remittance basis user.

We regularly assist clients in relation to all aspects of the Rules, including how to factor them into planning, exactly which forms of gains and income can be caught by them and how to make suitable declarations to HMRC if they become relevant.

Want more Burges Salmon content? Add us as a preferred source on Google to your favourites list for content and news you can trust.

Update your preferred sourcesBe sure to follow us on LinkedIn and stay up to date with all the latest from Burges Salmon.

Follow us