Sustainable Aviation Fuel: On the Flight Path to Revenue Certainty – Part 2

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

/Passle/5d9604688cb6230bac62c2d0/SearchServiceImages/2026-02-11-11-51-51-397-698c6d57ec7fccbd8c7678e2.jpg)

Sustainable Aviation Fuel: On the Flight Path to Revenue Certainty – Part 2

Last month the Department for Transport (DfT) launched a consultation on its approach to delivering the SAF revenue certainty mechanism (RCM).

Our previous article at the end of January set out our view of 5 of the key areas to consider in relation to the proposed terms for the RCM contracts. In this article, we look at the government’s “minded to” position for how those contracts will be allocated for the first allocation round, known as SAF AR1. As a reminder, the consultation closes on 3 April 2026.

So what’s being proposed?

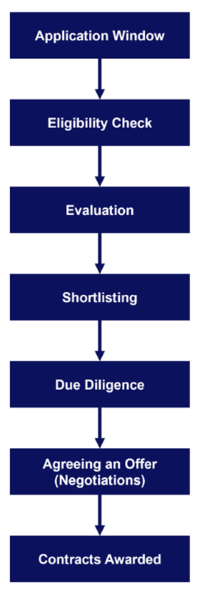

The market has seen allocation models before – for example, in nuclear/other low-carbon electricity Contracts for Difference and Hydrogen. Having assessed several allocation models, the Government’s minded to position for SAF AR1 is to use a tendered bid process with bilateral negotiations. This process will consist of a number of stages, as illustrated and outlined in more detail below.

Much will be familiar to those with knowledge of existing allocation round models:

1. Application Window

Applicants will be able to submit bids at any time during the application window period. It is not yet clear when SAF AR1 will be launched or how long the application window will be open – but we expect to find detail on this when the SAF AR1 applicant guidance is published in due course. The guidance will also include information on how to submit bids and what documentation will be required.

2. Eligibility Checks

All applications will be assessed on a pass/fail basis against pre-defined eligibility criteria designed to minimise speculative applications and speed up the process to focus on the most deliverable projects which will produce SAF which is eligible for SAF Mandate certificates.

The Government’s minded to position is that these criteria will include:

3. Evaluation Criteria

Projects which pass the eligibility check will then move onto the evaluation phase. This phase is a “holistic assessment” of applications based on deliverability, normalised strike price and economic benefits. Each of the evaluation criteria has been allocated a weighting and the application’s final total will be calculated using the final scores for each criterion multiplied by the associated weighting.

This criterion evaluates the applicant against several deliverability metrics including applicant’s organisational capability, the project’s current level of development and credibility of plans to complete all future development to reach commercial operations within the selected delivery year.

For this stage, a more comprehensive and detailed set of delivery metrics is proposed, supplementing the eligibility stage requirements set out above. The consultation does not set out how these metrics will be evaluated (but promises more detail in the SAF AR1 applicant guidance) save that scoring will reflect the “clarity and level of definition demonstrated…with bids scored higher if they can demonstrate greater organisational, project, technical and commercial deliverability”.

For SAF AR1 to be successful, it will be important to ensure that these metrics requirements can be meaningfully scored and that there is a clear distinction between the eligibility hurdle and the evaluation requirement.

This assesses projects on their cost-effectiveness in delivering carbon savings by comparing the price of SAF per tonne of carbon dioxide avoided relative to fossil fuel, adjusted for differences in technology, feedstock and lifecycle GHG performance. The strike price and GHG emissions savings submitted with a bid must reflect the project’s expected performance at the Target Commissioning Date (rather than projected future savings) and projects with a lower normalised strike price will score higher, reflecting better value for money.

This criterion assesses a project’s contribution to the UK economy, including job creation and wider economic benefits, alongside its carbon reduction impact. It reflects the role of the SAF Mandate in supporting the development of a sustainable, long‑term UK SAF industry capable of delivering skilled employment and investment.

4. Shortlisting

Following the evaluation stage, a longlist of projects with the highest evaluation scores will be assessed against how well their project aligns with the strategic allocation objectives (see below). Further detail on scoring thresholds, minimum scores and the number of projects to be longlisted or shortlisted is not provided in the consultation and is expected to be set out in the SAF AR1 applicant guidance.

However, where the government considers that the round is oversubscribed, or that evaluation results have created a portfolio imbalance across technology, feedstock, delivery timing, size or location, the government may apply portfolio factors and select lower‑scoring projects where this improves overall balance. The consultation states that the government retains full discretion on any “imbalance” decision - a primary driver for the SAF AR1 “tendered bid” approach is to reduce over-reliance on a single pathway and ensure different production technologies and feedstocks are supported.

This should therefore be a particular area of focus for prospective developers to respond to as part of the consultation. Developers should also start to consider how they will distinguish their project from others who may be applying to SAF AR1, particularly if their proposed technology is similar to a number of other projects, to ensure they come out on the right side of such a decision should the government adopt this position.

5. Due Diligence

Shortlisted applications will be invited to progress to an open book due diligence assessment to verify the key technical and commercial assumptions, through detailed costs and assurance assessment, compliance checks to assess lifecycle carbon intensity of the SAF to be produced as well as ‘know your customer’ (KYC) style checks.

6. Agreeing an offer

Applicants who pass the due diligence stage will engage directly with government to agree an offer for RCM support, with a focus on the key contract terms of the front-end agreement such as the strike price and target commissioning date. Following conclusion of these engagements, applicants will be asked to submit Best and Final Offer (BAFO).

7. Contracts awarded

Following BAFO, projects will be awarded RCM contracts where the government is satisfied with the agreed terms and strike pricing. The consultation does not explain how BAFOs will be assessed or how final contract‑award decisions will be made, with this detail also expected to follow in the SAF AR1 applicant guidance. It is not currently clear the number of contracts which the government anticipate offering as part of SAF AR1.

The Overall Allocation Strategy

As well as outlining the approach for AR1, the consultation summarises the government’s “minded to” positions on developing an overall allocation strategy for RCM contracts to provide further long-term clarity. At present, the overall allocation strategy is expected to include:

Whilst the government is presently focusing on the tendered bid with bilateral negotiation process for AR1, the consultation highlights that – if the market matures – there would be benefits in transitioning towards a price-based allocation for future rounds to drive longer-term value for money and ensure GHG emission reductions are supported..

Next steps

It is expected that the overall allocation strategy, as well as an indicative timeline for SAF AR1, will be published during 2026 once the government has considered stakeholder responses to the consultation.

Given that obtaining an RCM contract will likely play an important role in deciding which developers (at least in the near term) are able to secure finance for their projects, it is important that all stakeholders understand and provide input on the proposed allocation approach now. Nothing is decided and DfT intends to appoint a delivery partner to support the detailed design of the allocation process in the near future.

The consultation closes on 3 April 2026 and the government anticipates that the required legislation to implement the RCM will be laid by the end of 2026, including any associated regulations.

If you would like support from us in providing a response to the consultation, or gaining a better understanding of the proposed approach for SAF AR1, then please contact Nick Churchward, Greg Fearn or your usual Burges Salmon contact.

This article was written by Nick Churchward, Greg Fearn, Sasha Anisman, Ellen Matthews and Ishbel McCormack.

a portfolio approach to allocation is key for government in the early phases...to reduce over-reliance on a single pathway and ensure different production technologies and feedstocks are supported...in SAF AR1.

Want more Burges Salmon content? Add us as a preferred source on Google to your favourites list for content and news you can trust.

Update your preferred sourcesBe sure to follow us on LinkedIn and stay up to date with all the latest from Burges Salmon.

Follow us